“I am an optimist. It does not seem too much use being anything else.”

– Winston Churchill

I have a confession to make. I can’t hold it in, or deny it any longer, and so I’m just going to come out with it.

I’m an optimist. I have an unshakeable faith in the future, and the fact that things will continue to get better in the world, just like they always have in the past. I always think things are going to turn out better than anyone else expects, and I always consider bad news and fear as just setbacks on the way to the amazing things that lie ahead.

I am aware that this view of the world makes me a foolish Pollyanna. I’m a naïve and childish, a “pie in the sky” person, and I’m ignorant of all of the very good and factual reasons why the world is rife with problems that threaten us, and could destroy our quality of life. I don’t seem nearly as smart as those who are more pessimistic than I am. They seem much more intelligent, more in command of the actual facts, much more “in the know” than I am. I know it is much more fashionable to be a pessimist.

Lucky for me, despite all of that, the facts of human history almost unanimously justify my optimism.

Recency Bias and the Human Brain

There is nothing the human brain hates more than uncertainty. We crave the comfort, and sense of well being that comes from knowing what is going to happen to us in the future, and we will do anything we can to avoid the feeling of fear that comes from being uncertain about our future. As a result, our brains are constantly trying to make predictions, desperately trying to use the limited information we have about the world we are living in now, to help us form a belief about what is going to happen in the future.

Unfortunately, we also have extremely limited tools and skills for doing this well, and so we are pretty terrible at making predictions. Moreover, the tools we do have are likely to cause us to make predictions that overstate the likelihood of a bad outcome, instead of a good one, especially when we are predicting the outcome of a situation that is problematic, or troubling to us.

When we need guidance about how the future will play out, our only measuring stick is what is happening now, so we instinctively overweight our recent experience when predicting what is going to happen next. When we are confronted with a worrisome situation, we instinctively reach into our cognitive toolbox, grab our trusty sense of “Recency Bias”, and we start exercising our skills for extrapolation. We begin to extrapolate the current problematic conditions we are facing now, into the future. We make a prediction based on the idea that what is happening now will continue happening as far as the eye can see.

This cognitive method is hard-wired into all of us, even though it almost never works, and usually causes us to expect things to be a lot worse than they turn out. It exposes our blind spot, which is that some unpredictable event or condition will intervene out of the blue, and completely change the game with respect to that particular problem. This happens all the time, and it’s why really smart “experts” and gurus in almost every area of life are made to look foolish when they make predictions. It doesn’t matter if its sports, politics, economics or the weather, unpredictable and game-changing factors almost always intervene to make our predictions look silly.

The Great Horse Manure Crisis

History is littered with examples of problem situations in which “experts” made a pessimistic prediction that proved to be spectacularly wrong. The examples are as numerous as the stars. My favorite example, which I think is a really effective demonstration of this phenomenon, is known as The Great Horse Manure Crisis of 1894. As described in the website “Historic UK”:

By the late 1800s, large cities all around the world were “drowning in horse manure”. In order for these cities to function, they were dependent on thousands of horses for the transport of both people and goods.

In 1900, there were over 11,000 hansom cabs on the streets of London alone. There were also several thousand horse-drawn buses, each needing 12 horses per day, making a staggering total of over 50,000 horses transporting people around the city each day.

This huge number of horses created major problems. The main concern was the large amount of manure left behind on the streets. On average a horse will produce between 15 and 35 pounds of manure per day, so you can imagine the sheer scale of the problem. The manure on London’s streets also attracted huge numbers of flies which then spread typhoid fever and other diseases

Each horse also produced around 2 pints of urine per day and to make things worse, the average life expectancy for a working horse was only around 3 years. Horse carcasses therefore also had to be removed from the streets.

This problem came to a head when in 1894, The Times newspaper predicted… “In 50 years, every street in London will be buried under nine feet of manure.” This became known as the ‘Great Horse Manure Crisis of 1894’.

The terrible situation was debated in 1898 at the world’s first international urban planning conference in New York, but no solution could be found. It seemed urban civilization was doomed.

However, necessity is the mother of invention, and the invention in this case was that of motor transport. Henry Ford came up with a process of building motor cars at affordable prices. Electric trams and motor buses appeared on the streets, replacing the horse-drawn buses.

This crisis is a great example of what I call The Extrapolation Fallacy, which always features the following ingredients:

- There is an actual problem that a broad population of people are starting to take notice of, because it appears to be getting worse. People are afraid of what will happen next, and confused about what to do.

- Highly intelligent experts, in full possession of the facts about the current trajectory of that problem, begin using current facts to extrapolate the future consequences of the problem. Unfailingly, they fall prey to “Recency Bias”, and project the current conditions indefinitely into the future. Usually this results in dire predictions for the future of this problem.

- These predictions become sensationalized by the media, such as The Times Newspaper We must never forget the age old mantra of all media professionals: “If it Bleeds, it Leads”. In 1894 as in 2020, the media make their living by peddling fear, and they have professional level skills for fear mongering.

- The fatal flaw in the experts’ dire predictions was that a “game changing” development would come about, out of nowhere, that totally changed the nature of the problem.

- That game changing development arose out of human ingenuity and innovation. When faced with a seemingly unsolvable problem, the collective human brain set itself to finding a solution, and innovated a way to do so.

- Eventually, when viewed from the rear view mirror, the fear and concern over the problem ends up looking foolish.

This pattern has been repeated literally hundreds of times in history, from Robert Malthus predicting in 1798 that the world would run out of food within a century, to the AIDS/EBOLA/SAARS/Swine Flu epidemics, to the Y2K crisis, the Financial Crisis of 2008, the “Peak Oil” hysteria of last decade, and so on.

Extrapolating the Coronavirus

So how does the current hysteria over the Coronavirus compare to the Great Horse Manure Crisis? So far, we have the perfect cocktail of all the proper ingredients:

Ingredient #1: There is an actual problem that a broad population of people are starting to take notice of, because it appears to be getting worse and people are confused about what will happen next.

Check. No doubt about it.

Ingredient #2: Highly intelligent experts, in full possession of the facts about the current trajectory of that problem, begin using those facts to extrapolate the future consequences of the problem. Unfailingly, they fall prey to “Recency Bias”, and project the current conditions indefinitely into the future. Usually this results in extremely dire predictions for the future of this problem.

Check, at least partially. Yes, many experts are using extrapolation to make extremely dire predictions. According to the Imperial College Study, which is currently available on the internet, current data conclude that it is possible that 4 million Americans, and 90 million people globally could die in the next several months, which is 1.5x as many people who died in WW2.

However, the main difference here is that nobody is “in full possession of the facts”. Because of the relative unavailability of reliable testing methods, and the fact that the official numbers indicate that this virus has only infected roughly .00027% of the world’s population so far, any conclusions drawn from the current available data are speculative. The only thing we can be almost certain of is that the numbers we are seeing now for total infections, total hospitalizations, and death rate are inaccurate, because the data is so incomplete. The only thing we don’t know is if the current numbers are off by a factor of 3 or a factor of 300. All we can say for sure at this point is that this virus has a long way to go until it hospitalizes or kills even as many people worldwide as the flu does. Let’s hope it never gets even close.

Ingredient#3: These predictions become sensationalized by a hysterical media, as the Times Newspaper broadcast the Horse Manure crisis.

Check. This is the Super Bowl for the catastrophist media. Its even worse now than ever before because now they have a new toy, which is called Social Media.

Ingredient #4: The fatal flaw in the experts’ dire predictions was that a “game changing” development would come about, out of nowhere, that totally changed the nature of the problem.

Undetermined so far. We all hope so, I am betting on it.

Ingredient #5: That Game Changing development arose out of human ingenuity and innovation. When faced with a seemingly unsolvable problem, the collective human brain set itself to finding a solution, and innovated a way to do so.

Undetermined so far.

This is where I will be considered naïve and childish by many “smart” people. Of course, it is foolish to count on humanity innovating a way out of this problem, and using our ingenuity to solve it. There is no evidence that something like that will happen, and it seems much more like a hope than a reality. At the same time, nobody counted on Gerald Ford inventing the automobile to solve the horse manure problem either. It is my opinion that human innovation is actually the only thing we can truly count on.

How will that happen? Don’t ask me, I’m not a scientist, but here’s a scenario I could envision:

This crisis has been compared to a war, which is a great analogy. Right now we are fighting the “Ground War”, and as with any war this is the messiest and most difficult part of the campaign. We are trying to mitigate the growth of the virus through social lockdowns, washing our hands, and taking our vitamins. These methods will help, but they will be almost impossible for us to continue for long, because sooner or later we will realize they are causing us more misery through economic destruction and other unintended consequences than they are saving us by staving off the enemy.

However, we have now also called in our most elite fighting troops, who are joining the battle in full force. We are blessed with a worldwide community of doctors, biotech and medical experts, and research scientists, many of whom are the smartest people in the world. These elite warriors are outfitted with the finest weapons of disease destruction ever seen in human history: from genetic engineering, to supercomputing, to advanced medical devices, the technology they have at their disposal is literally mind boggling. They are all single mindedly focused on this problem, are learning volumes of new information every day about how to fight it, and they will defeat it. They will develop a new drug, a vaccine, a treatment, or some yet unknown way to defeat this virus – and I’m betting they will do that much faster than anyone expects.

This process is already happening, at a rapid pace. Consider the following developments, which have occurred in only a few weeks time:

- Roughly 10 days ago, when the Coronavirus crisis first started gaining momentum in the United States, leading scientists and government officials announced that it would most likely take 3-4 months for a vaccine to be developed which would be suitable to even begin human trials. Instead, drug company Moderna started a human trial for their vaccine on Monday March 16th. There is no guarantee that these trials will produce a vaccine, and most experts believe it will be at least a year until an approved vaccine is available. Regardless, the process of finding a vaccine has begun roughly 3 months faster than originally expected. Given the sickness and death that the virus could cause in 3 months, this development has already changed the game.

- More immediately, the race is on to develop a treatment drug, and major progress is being made. There are too many of these to list fully, but among those I’ve found most interesting:

- This week, Gilead Sciences started a 10 day clinical trial this week on a drug called Remdesivir for which they have expressed high hopes.

- The CEO of Biotech company Regeneron has expressed publicly that they hope to have a treatment “quickly”. Regeneron produces an arthritis drug called Kevzara which is already in human trials, which has shown effectiveness in treating the virus. It is also an existing drug which is already approved for human use, and is plentiful in supply. The Regeneron CEO also said about creating a new, custom designed drug that: “ We’ve already had remarkable success and gotten hundreds of antibodies that neutralize this virus. We’re going to pick the best and manufacture a cocktail.”

- The White House recently held a press conference to discuss a malaria drug called Chloroquine, which has been used in combination of other medicines in other countries, with apparent success. According to the “Marseille Study” of this drug done in France, the lead researcher on the study was quoted that the administration of this drug along with an antibiotic showed there was “a spectacular reduction in the number of positive cases”. There are many similar glowing claims being made about this drug by doctors in China, South Korea, and India. This drug has also been approved for human use, and is available in large quantities.

- Steven Hahn, the head of the FDA has also tempered expectations about these drugs, which is of course his job to do. All of these drugs must undergo additional human trials before they will be suitable for the FDA to recommend them for use as treatments. However, these drugs are already approved for safe human use, and so doctors can still prescribe them, which they are already doing.

Ingredient #6: Eventually, when viewed from the rear view mirror, the fear and concern over the problem ends up looking foolish.

Of course, time will tell on this one. I think you can probably guess what I’m betting.

The Economic and Financial Crisis

Finally, I’m a professional investment planner, so let’s take a look at the current economic and financial crisis that is being caused by the spread of the coronavirus.

Another way that Recency Bias strikes is that we have a very limited ability to see the similarities in our current situation, to events that have happened in the past. We always think that the current problem we are facing is without precedent, and has never happened before, when in reality it just hasn’t happened to us before. Although we know that economies and stock markets have always dealt with past challenges and continued to thrive, our inclination is to believe that “This time is different” than any other crisis the world has experienced before: this could be the one crisis that finally brings it all crashing down around us, and for good.

Billionaire investor Bill Ackman gave a dire interview on CNBC this week in which he argued that this crisis is different, and worse than anything we have seen before. He was quoted using the phrase that “hell is coming”, as well as the words “America will end as we know it”. With all due respect to Mr. Ackman, that’s what they always say when a Bear Market strikes. This is the language of panic, and it is how you know you are in a Bear Market. It is also a good sign that fear may be near its peak.

Recency Bias will blind most investors to the historical facts, and cause them to feel they cannot make sense of what is happening, because they can’t call to mind any past experience to draw from to understand how this crisis will end. Here is just a small sample of the facts that most people will miss:

- A mere 12 years ago the world experienced a stock market, banking, and economic and banking crisis which was much worse than this crisis has been so far, particularly because our economy and banking system were far more compromised than they are now. During that crisis, the S&P 500 declined by 57% from its prior high, compared to a decline of about 30% so far this time around. 10 years after the bottom of that crisis, the S&P 500 was over 3x higher, not including dividends.

- Long before coronavirus became part of our lives, in late 1957 and early 1958 the US was hit by the “Asian flu,” which killed almost 70,000 in the US. Real GDP was growing around 3% annually in 1957, but as the flu started to peak in Q4, the economy shrank at a 4.1% annual rate, followed by an annualized 10.0% plunge in the first quarter of 1958, the deepest drop for any quarter in the post-World War II era (from 1947 through 2019). But then, right after the plunge, the economy rebounded at a 7.8% annual rate for the next five quarters.

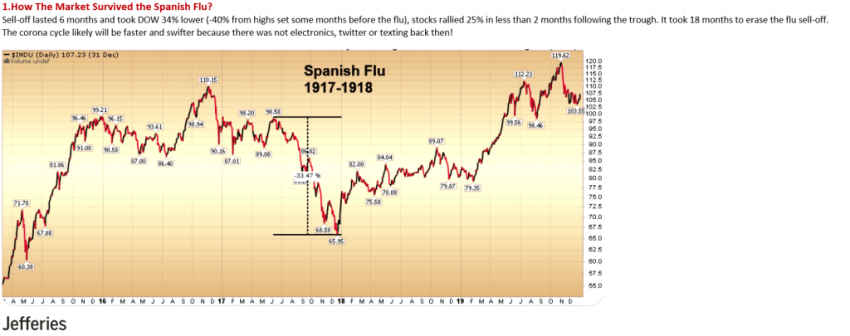

- Although the “Spanish flu” struck the world more than 100 years ago, a time that seems almost Pre-Historic to most investors today, it provides the most extreme precedent we can draw from. That outbreak began in the summer of 1918, and had run its course by February 2019. It infected 500 million people worldwide, which was about 27% of the world’s population at the time, and killed between 30 million and 50 million people, or about 1.7% of the entire world’s population. Were a similar pandemic to hit us today, it would translate to 100 million deaths. From a stock market perspective, the Dow Jones Industrial average fell by 40% from its prior high over the first 6 months of the pandemic. It bottomed in December of 1918, about 3 months before the flu virus was over, and subsequently rallied by 25% in less than 2 months. 18 months from hitting bottom, the Dow surpassed its prior all time high, not including dividends. Not to mention, but that high was 110. Today the Dow Jones trades at a level of about 20,000. No, America did not end.

- Finally, while the last few weeks in the stock market have been tough, the decline in equites so far is hardly without precedent. In fact, with the current decline just shy of 30%, this only ranks as the 13th worst bear market in stocks going back to the 1920s. Here is what happened after each of those last 12 bear markets hit bottom:

The phrase “This time is different” is a classic joke among professionals who manage money for a living, because it is never different. While it is possible that any particular market crisis might turn out differently than any of the scores of bear markets that came before, don’t bet on it. It may seem impossible now to believe it, but the coronavirus will eventually run its course, and will go away. It may take a long time, and it may make a lot of people sick, but eventually it will be over. When that time comes, does anyone really believe that “America will be over”? Yes, the economy will be damaged, bankruptcies will occur, and the stock market may take time to recover. But does anyone seriously believe that people will never go to a restaurant, or a movie, or take a vacation again? And that the miracle of entrepreneurialism and capitalism will be incapable of picking up the pieces and re-generating itself?

Based on the facts of history, the stock market will eventually hit bottom and start moving up, and will do so well in advance of any evidence that the virus is subsiding. When the great financial crisis ended on March 9th of 2009, the Wall Street Journal did not publish a headline saying that “the coast is clear”, and its’ safe to start investing again. No, on that day the news was still miserable. There will be no headline proclaiming the bottom, but when it comes, the upward force of the rally in equity prices will be generally proportional to the force of the decline we have seen, just like in past bear markets. By September of 2009, stock prices had already appreciated by 35%. The bottom will come quietly and without fanfare, and when it does, take a look at the chart above to understand what will happen next.

Be of good cheer and stay positive. This too shall pass. And I’m betting a lot faster than anyone thinks. In the meantime, please wash your hands, take your vitamins, and stay safe and healthy.