“The right time to buy equities for the long term is whenever you have the money”

– Nick Murray

In last month’s article, we focused on “Not Trusting Robots” as one of the great qualities to adopt for anyone who wants to become a great investor. This month we focus on a similar, but slightly different quality…Great Investors know it is NEVER a “Good Time” to Invest

Chaos vs. Stability

Most people live with a flawed understanding about the nature of world events, which can be a critical misconception when it comes to their investing decisions. Specifically, most people mistakenly believe that the world is constantly alternating between tranquil periods of certainty and stability, and scary periods of chaos and instability.

When faced with the anxiety of chaotic world events, our brains are wired to seek relief from our mental stress, and to satisfy our need for stability and certainty. We commonly do this in two ways: we become nostalgic, and tell ourselves that the past was a happier, simpler, calmer time, or we look forward to better days in the future, when “things will be calmer and more stable in the world”.

This tendency has important implications on our actions as investors. When faced with important wealth planning and investing decisions, the instability of current events can make us feel nervous and uncertain, which can cause us to procrastinate important decisions and actions, and paralyze our decision making. We tell ourselves that it is best to wait for the next period of certainty to get here, and for “things to calm down” in the world, and our decisions will become easier.

Unfortunately, the fact is that instability is a constant feature of world events, and the world lives in a constant state of chaos. A review of history reveals that the world is constantly flowing from one crisis to the next – there is always a crisis happening somewhere, and the world lives in a constant state of instability.

“A Good Time to Invest”

When it comes to investing, our basic human need for need for certainty and stability can paralyze us, and cause us to postpone important actions and decisions because we feel the world is too uncertain. We have a basic desire to wait for a “Good Time to Invest” when the world is stable and certainty is the norm. Great investors understand that such a time never comes, and it is never a “Good Time to Invest”, because chaos and unpredictability are a permanent feature of the world.

For a glimpse of this reality, below we have reproduced one of our favorite charts, which depicts the history of chaotic world events over the last 67 years. As this chart shows in graphic detail, the world has been a dangerous and chaotic place since 1950, marked by a constant stream of terrorism, wars, assassinations, financial crises, natural disasters and political strife.

However, this chart is important for another reason: it depicts the behavior of the stock market over this period. As of today’s writing, the S&P 500 is almost 150 times higher than it was at the end of WWII, with a dividend yield which is also 65 times higher.

Indeed, thanks to current events, it has never felt like “A Good Time to Invest” since 1950, but the market behavior proves that it has actually always been “A Good Time to Invest.”

Popular culture and the financial media have taught us all to believe that markets are dictated by the chaotic and unstable nature of global events, and that any order we perceive in the markets can cease to function at any moment, and with the onset of any crisis. Great investors accept the fact that it is our emotions which are causing us to misunderstand the chaos we perceive, and that the chaos is simply part of a larger order of things that we do not understand, and therefore we fear.

As Nobel Prize winner Marie Curie said: “Nothing in life is to be feared, it is only to be understood”. Capital markets are never to be feared, they are only to be understood.

A Correction is Coming!

Today’s markets present us with a classic example of this misconception in action which have written about a few times [see our post: A Correction is Coming, a Correction is Coming!]. It seems every time we turn on the financial news or open the business section of the newspaper, we are told that now is a “Terrible time to Invest”. The most popular reasons seem to be:

- Donald Trump is a Wild Card, and a destabilizing influence on world events.

- The stock market has gone up too much, too quickly, and is due for a correction.

We will refrain from making political comments in this space, but it appears that both sides of the aisle can agree that the Trump White House is grabbing a lot of headlines these days. However, we will reiterate the dangers of allowing our politics to influence our investment decisions. As we have written in the past [see our post: Permanent Chaos], another classic mistake that investors make is allowing our emotional reaction to politics influence our outlook on markets. The US has had 45 presidents since our founding – some have been quite good, but others have been pretty bad as well. Generally speaking, the stock market has done pretty well regardless of who is in the Oval Office.

We will also refrain from making short term “market predictions” here, and we have no idea if the stock market is “ripe for a correction” as many pundits are suggesting. On the one hand, it is true that the S&P 500 has enjoyed a relatively long period of advance without a correction. On the other hand, history shows that the S&P goes up about 75% of the trading days, so the odds favor the bullish.

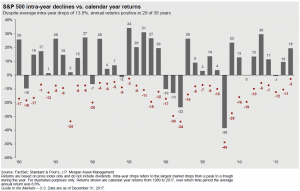

In the effort to analyze the possibility of a correction with understanding, instead of fear, we have reproduced below our favorite chart of the history of market corrections.

In the chart above, the grey bars represent the annual increases in the S&P 500 each year, going back in time to 1980. The red dots represent the “intra year” decline suffered in each year.

Upon studying this chart, we can draw some important conclusions about the history of market corrections:

- It is quite common to experience a double digit correction, even in a year when the total return of the S&P 500 is up by double digits as well.

- Between 1980 and 2016, the average yearly “intra – year” decline in the S&P 500 has exceeded 14%. This means that, on average, the stock market declined by 14% at least once a year!

- During that period of 37 years, the stock market produced positive annual returns 28 times, and the index moved from 106 at the beginning of 1980 to 2250 by the end of 2016.

- Corrections happen all the time, and should be expected on average at least once a year, even in bull markets.

Most investors consider now to be a “bad time to invest”, because they fear the onset of a market correction. Armed with this historical insight about the history of corrections, the Great Investor is always prepared for the possibility of a correction, but understands that the risk of a brief corrective period seems minor in comparison to the long term return potential of investing patiently over time in equities.

Having a Plan

The very best investors have a disciplined approach to making portfolio decisions, and always stick to their plan, no matter what the rest of the world is doing. They don’t let their emotional reactions to chaos and unpredictability throw them off track, and they understand that a well-designed written investment and financial plan will get them through both.

No predictions. No witch doctor investment sorcery or magic investing formulas. No “Black Boxes”. Just intelligent planning, patience and discipline.

Leave A Comment