“News is a money making industry. One that doesn’t always make the goal to report the facts accurately… Fear-based news stories prey on the anxieties we all have and then hold us hostage… In previous decades, the journalistic mission was to report the news as it actually happened, with fairness, balance, and integrity. However, capitalistic motives associated with journalism have forced much of today’s television news to look to the spectacular, the stirring, and the controversial as news stories. It’s no longer a race to break the story first or get the facts right. Instead, it’s to acquire good ratings in order to get advertisers, so that profits soar.”

– Deborah Serani Psy.D. Psychology Today

Readers of our blogs and articles know well that we have long been critical of the “Fear Based” reporting in the financial media. In our view, the financial media has no interest in reporting the truth, or in educating readers and viewers, but instead in deliberately disturbing consumers about the latest global crisis. Those who look to the financial media for true education or insight are likely to be misled, or at least distracted from the truth, by this constant fear mongering.

Consider for a moment the messages about investing which bombard you and your household every day by the financial media. You are told that the stock market is a dark, dangerous, and scary place, where you might lose all of your money at any moment. You are exhorted to be constantly vigilant and able to react to market volatility at every moment. To avoid such disastrous losses, you must check your stock portfolio on your iPhone several times a day. Certainly you should trade you portfolio while out to dinner, right?

You are encouraged to believe that the stock market is nothing but a giant casino, where the odds are stacked against you, and that unpredictable and unstable geopolitical events constantly threaten your financial well-being. In short, investing is complex, mysterious and dangerous, and markets will chew you up and spit you out if you are not careful.

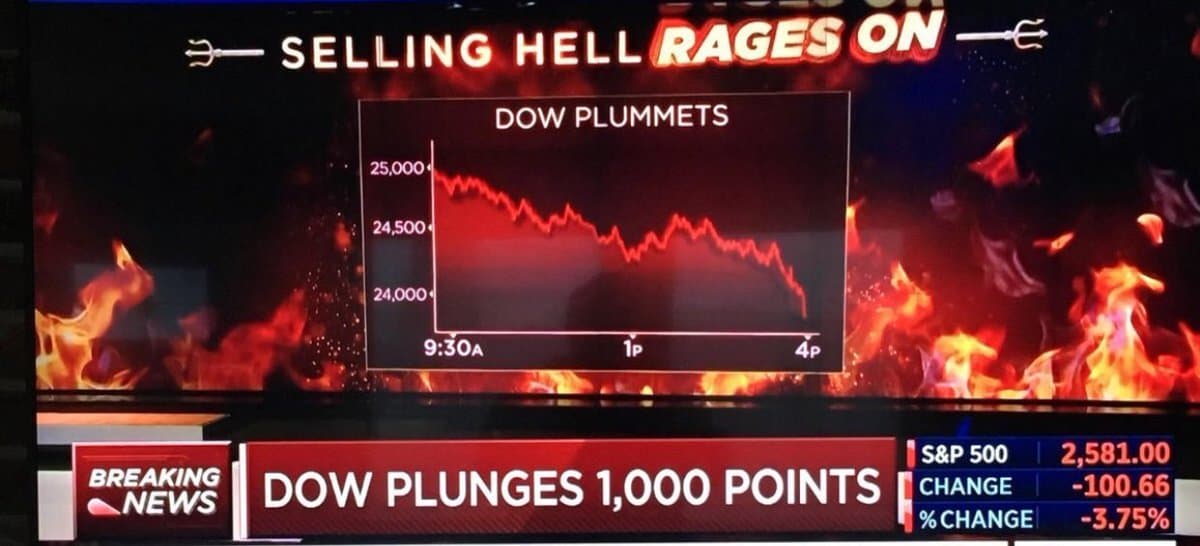

I recently saw a great example of this which made me chuckle. On Thursday February 8th, as I was getting dressed in my Philadelphia Eagles garb to head off to the Super Bowl victory parade in Philadelphia, I glanced at my television tuned to CNBC and saw this graphic:

“Selling Hell”? Complete with fire and pitchforks…pitchforks! Seriously CNBC?

Some perspective may be in order. Yes, the market had a few days of increased volatility and was certainly having a bad day. But there was nothing unusual about the sell off (or most sell offs). They are actually normal and expected, as we have written many times:

- Markets average one -14% annual decline.

- Daily dips of 2% or more occur about 5x a year.

Despite a week of selling in early February, the S&P 500 was up almost 22% in 2017. In fact, 2017 was the only year in recorded history in which the stock market increased every single month for 12 straight months. Better yet, since the lows of 2009, the S&P 500 was up by over 200%.

The best news of all? As you can see from the graphic in the lower right corner, the S&P 500 was trading at 2,581 the day this ridiculous graphic was broadcast. As I write this, 10 trading days later, the S&P 500 is 6.2% higher at a level of 2742. Where’s the graphic of the heavens opening up and the sun shining through?

If you run into a crowded movie theater and yell “FIRE” you could be arrested for inciting a riot. Yet that is exactly what CNBC did, complete with pictures of fire and brimstone..and to an audience of millions. They should be ashamed of themselves.

This kind of media hyperbole and irresponsible journalism goes on every day, with no purpose or intent other than to scare people into consuming more financial media. In the process, it breeds an irrational fear of the investment markets, and a sense of intimidation about the process of investing, that distracts many Americans from the opportunity to build real, long term wealth in the stock market.

Our advice: Don’t believe the hype. Turn off your TV.

And if you want to learn the true history of the stock market without the sensationalism, I suggest pick up Penn Professor Jeremy Siegel’s…Stocks for the Long Run 5/E: The Definitive Guide to Financial Market Returns & Long-Term Investment Strategies

Leave A Comment